By cutting Russian pipeline LNG exports to the EU in half, perhaps Ukraine can nudge the feds into supporting the energy industry again

Get the latest from Adam Zivo straight to your inbox

Published Jan 11, 2025 • Last updated 7 minutes ago • 4 minute read

Following the recent expiry of a five-year deal, Russian gas is no longer being piped into the European Union through Ukraine. This development will bolster continental security in the long term, and may benefit Canada by nudging European states into importing more liquified natural gas (LNG) from North America.

Before the taps were turned off on Jan. 1, Russia had piped gas through Ukraine for decades. While annual Russian revenues from these exports were approximately US$5 billion (C$7.2 billion), Ukraine was paid only US$800 million in transit fees per year, of which approximately 80 per cent was spent on operational and maintenance costs.

Advertisement 2

THIS CONTENT IS RESERVED FOR SUBSCRIBERS

Enjoy the latest local, national and international news.

- Exclusive articles by Conrad Black, Barbara Kay and others. Plus, special edition NP Platformed and First Reading newsletters and virtual events.

- Unlimited online access to National Post and 15 news sites with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles including the New York Times Crossword.

- Support local journalism.

SUBSCRIBE FOR MORE ARTICLES

Enjoy the latest local, national and international news.

- Exclusive articles by Conrad Black, Barbara Kay and others. Plus, special edition NP Platformed and First Reading newsletters and virtual events.

- Unlimited online access to National Post and 15 news sites with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles including the New York Times Crossword.

- Support local journalism.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Article content

After Moscow’s full-scale invasion in 2022, Ukraine could have immediately stopped the flow of all Russian gas through its territory by invoking a “force majeure” clause in its transit contract. However, it declined to do so until western allies were given more time to find alternative suppliers.

In the ensuing three years, EU states largely weaned themselves off Russian gas, such that Russia only accounted for around eight per cent of the bloc’s pipeline gas imports last year, down from 40 per cent in 2021. As of now, Norway is the EU’s largest gas supplier, providing around a third of imports, with American LNG a distant second, at around 20 per cent. Russian LNG continues to play a small but persistent role in EU energy security, and is mostly consumed by western European states.

However, a handful of central European states — Slovakia, Hungary and Austria — continued to rely heavily on Russian natural gas. In the first quarter of 2024, Russia provided 82 per cent and 85 per cent of Hungary and Slovakia’s gas imports, respectively, and 98 per cent of Austria’s supply in December 2023.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Advertisement 3

Article content

Almost all of this gas was piped through Ukraine into Slovakia, with the Slovaks then charging their own transit fees (around 500 million euros per year) to pass this gas along to other states. This system accounted for half of Russia’s pipeline exports to the EU last year, with the other half moving through the Turkstream pipeline, which runs under the Black Sea and connects the two markets via Turkey.

Notably, all three of these EU states have been friendly towards Moscow. Hungary, under the authoritarian rule of Prime Minister Viktor Orbán, has been a staunch Kremlin ally for years, while Slovakia veered into Moscow’s orbit last spring with the election of pro-Russian Prime Minister Robert Fico. Although Austria ostensibly opposes Moscow’s power, the country, and its elites especially, maintain deep political and economic ties with Russia, which has worried allies.

Critically, the Russian gas transiting through Ukraine also propped up Transnistria, an unrecognized pro-Kremlin client state (population: 367,000) which broke away from Moldova in the early 1990s. For decades, the region received Russian gas virtually for free, heavily subsidizing the local economy, while hosting thousands of Russian troops. Moscow has spent years trying to bill Moldova for this gas, using invented debt as a political cudgel.

Advertisement 4

Article content

Now, all of this gas has been cut off.

As Ukraine gave ample warning that it would not renew the transit agreement, no service disruptions are expected to occur in Austria, Slovakia or Hungary. Each country found alternative suppliers, predominantly from the West, although energy prices are nonetheless expected to rise. Hungary can still import some Russian gas through the Turkstream pipeline, but this longer route, which has limited capacity, is more expensive.

Infuriated, the Slovak government is now demanding that Kyiv either reopen its pipelines or compensate Slovakia for lost transit fees. Should Ukraine refuse to comply, Slovakia has threatened to slash badly-needed electricity exports to the country and reduce aid to Ukrainian refugees living on Slovak territory. However, Poland responded by promising more electricity to Ukraine should this occur.

As for Transnistria, refusal to seek out EU gas alternatives has paralyzed the renegade statelet. Almost all industry has ceased and 10s of thousands of residents have no heating or hot water, with over 100,000 more on rationed supplies. Transnistrian officials warn of an impending humanitarian crisis, and have advised families to conserve heat by hanging heavy blankets over their windows and sleeping together in one room.

Advertisement 5

Article content

As Moldova phased out most of its Russian gas imports in 2023, its heating remains intact. However, 80 per cent of Moldova’s electricity is supplied by a single Transnistrian power plant, which is predominantly fuelled by Russian gas and currently operating below capacity. Facing looming electrical shortages, Moldova plans on importing relatively expensive energy from Romania to meet its needs, but blackouts and price increases could destabilize the pro-western Moldovan government, which has struggled to survive amid Moscow’s persistent economic and political harassment.

Losing access to Ukrainian pipelines, and the associated US$5 billion in annual revenue, will not make a significant dent in Russia’s overall oil and gas exports, which totalled $US240 billion last year. For Ukraine, the real benefit is not economic warfare against Moscow, but rather the erosion of Russian influence over central Europe and the collapse of Transnistria as a client state.

Of course, Ukraine and its European allies aren’t the only beneficiaries here. In the scramble to replace Russian gas, Europe’s appetite for international energy sources has been growing. To illustrate: American LNG exports soared in 2022 and 2023 and, while demand softened in 2024, mostly due to higher power generation from renewables like solar and wind, the market remains strong.

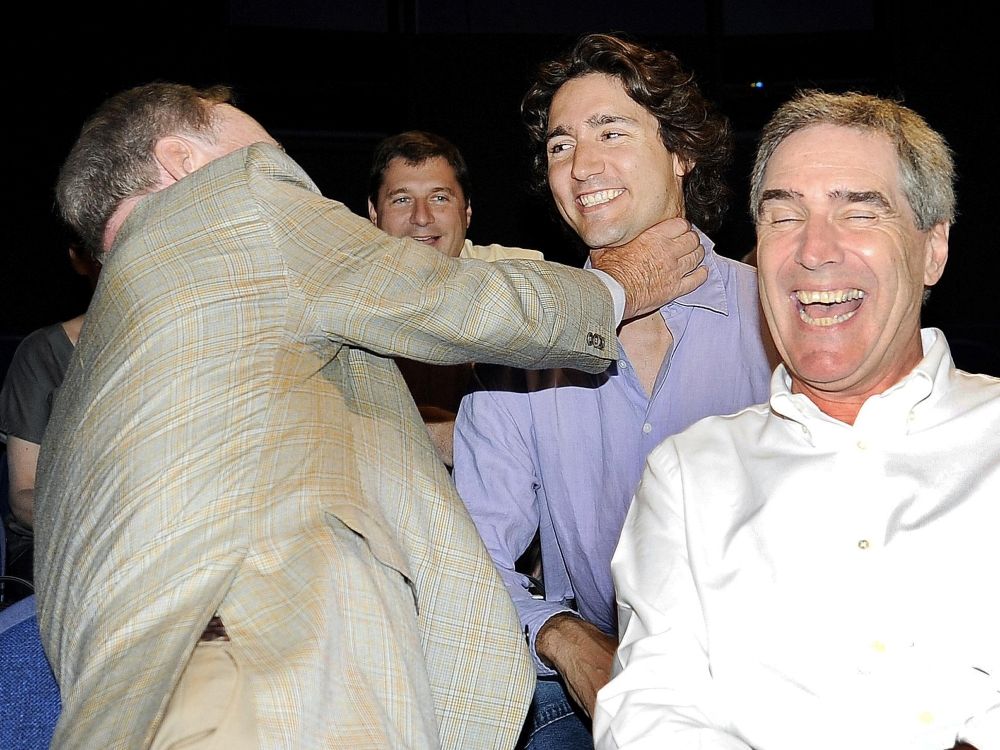

Canada can, and should, benefit from this in the long term. EU leaders have said that there is significant appetite for Canadian LNG, but, thanks to a lack of support from the Trudeau government, Canada has almost none of the infrastructure needed to export this commodity internationally. By decimating Russian pipeline exports to the EU, perhaps Ukraine’s lapsed transit agreement can nudge the federal government into a more rational approach.

National Post

Article content

Get the latest from Adam Zivo straight to your inbox

.png)

4 hours ago

8

4 hours ago

8

Bengali (BD) ·

Bengali (BD) ·  English (US) ·

English (US) ·