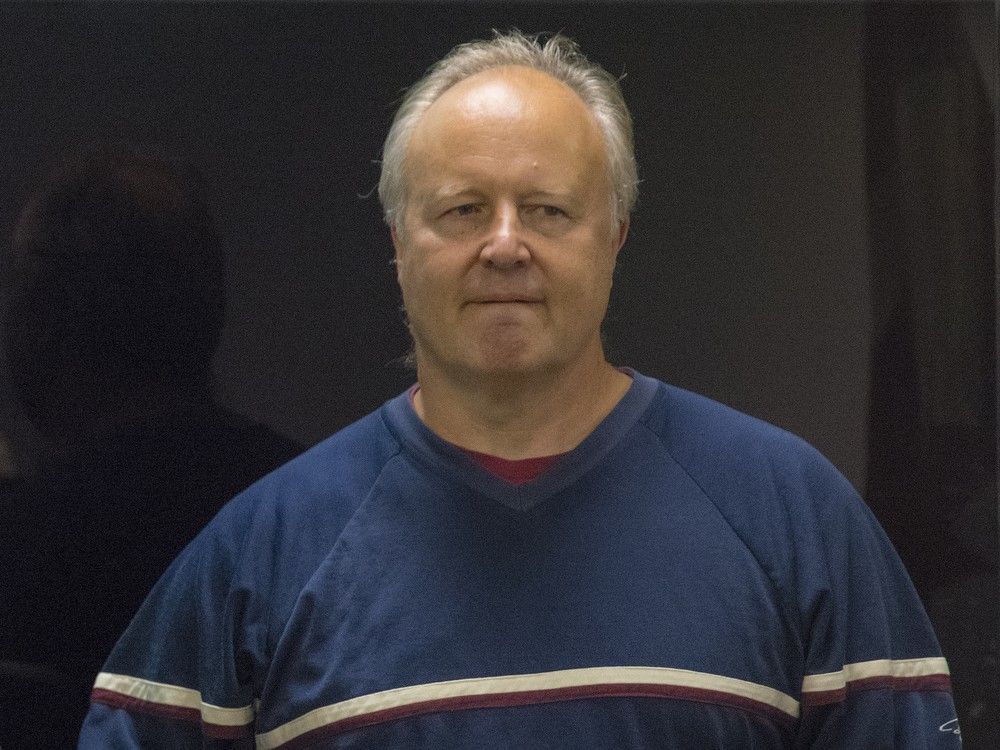

DETROIT — Investors misinterpreted a public offering last week by Lucid Group that raised roughly $1.75 billion — and led to the stock’s worst daily performance in nearly three years — CEO Peter Rawlinson told CNBC.

Rawlinson said the raise, which included a public offering of nearly 262.5 million shares of its common stock, was a timely, strategic business decision to ensure the electric vehicle company has enough capital for its ongoing operations and growth plans. It also should alleviate any potential worries that the company would need to issue a “going concern” disclosure regarding its operations, he said.

“We’d signaled that we had a cash runway to Q4 next year. As a Nasdaq company, we have to avoid a going concern. And a going concern is issued within 12 months of your financial runway,” Rawlinson said Monday from the company’s newly opened offices in suburban Detroit. “So, it should have been no surprise to anybody.”

But Wall Street analysts largely took a negative view of the move due to its timing. Several said the raise was unnecessary or came earlier than expected for the company, which had $5.16 billion of total liquidity to end the third quarter. That included more than $4 billion in cash, cash equivalents and investment balances.

The announced transactions also come two months after Lucid said Saudi Arabia’s Public Investment Fund had agreed to supply the company with $1.5 billion in cash, as the EV maker looks to add new models to its product line.

“A cap raise was slightly larger and earlier than we had expected,” Morgan Stanley analyst Adam Jonas wrote following the raise being announced Wednesday after markets closed.

RBC Capital Markets analyst Tom Narayan shared similar thoughts: “We suspect that investors will wonder why LCID is raising more capital just after it secured the PIF capital in August, and at currently depressed share price levels. We expect Lucid shares to trade sharply lower as a result,” he wrote in an investor note Wednesday night.

Rawlinson on Monday reiterated that the company would raise capital “opportunistically.” He said the company’s current funds now secure its capital into 2026, ahead of it launching a new midsize platform later that year.

“This is exactly as expected. It is exactly to the playbook. It should have come as zero surprise to anyone,” he said. “And why did I choose this moment? Because I didn’t want to string it out to the end, because I didn’t have to.”

Shares of Lucid declined roughly 18% on Thursday after the announcement — marking the worst daily decline for the company since December 2021.

Rawlinson said Lucid is currently in a highly capital-intensive investment period as it expands its sole U.S. factory in Arizona; builds a second plant in Saudi Arabia; prepares to launch its second product, a SUV called Gravity; develops its next-generation powertrain; and builds out its retail and service network.

“Those five categories are the long-term investment for the future that we’re making now,” Rawlinson said. “Have we got to cut costs with every car we’re making? Absolutely.”

Last week’s announcement was made in conjunction with plans for Lucid’s majority stockholder and affiliate of PIF, Ayar Third Investment Co., to purchase more than 374.7 million shares of common stock from Lucid to maintain its roughly 59% ownership of the company.

Such a transaction is called pro rata, which allows an investor such as PIF to participate in future rounds of financing and retain its ownership stake. It’s something the PIF has routinely done with Lucid.

Individual investors were likely concerned by share dilution following the action, but Rawlinson said the continued support of the PIF should be viewed as a positive.

“I think it’s been misinterpreted and misreported,” Rawlinson said. “The norm is to go pro rata. If we didn’t go pro rata, it surely would be a signal that the PIF were losing faith in us.”

Lucid last week said the public offering was expected to raise about $1.67 billion, with a 30-day option for underwriter BofA Securities to purchase up to nearly 39.37 million additional shares of Lucid’s common stock as well.

Lucid has reported record deliveries this year of its current model, an all-electric sedan called Air. The company expects to produce 9,000 vehicles this year. Production of its Gravity SUV is expected to start by the end of this year.

However, Lucid’s sales and financial performance have not scaled as quickly as expected following higher costs, slower-than-expected demand for EVs, and marketing and awareness problems for the company.

.png)

3 hours ago

11

3 hours ago

11

Bengali (BD) ·

Bengali (BD) ·  English (US) ·

English (US) ·