Due to a new federal law, the HST has been removed from restaurant meals, among other purchases, until Feb. 15.

Get the latest from Peter Hum straight to your inbox

Published Jan 04, 2025 • 3 minute read

When Nara Sok recently treated himself to a dinner out at a Chinese restaurant on Merivale Road, the bill pleasantly surprised him.

“My typical $100 bill was only $80-something,” says Sok. “That felt nice.”

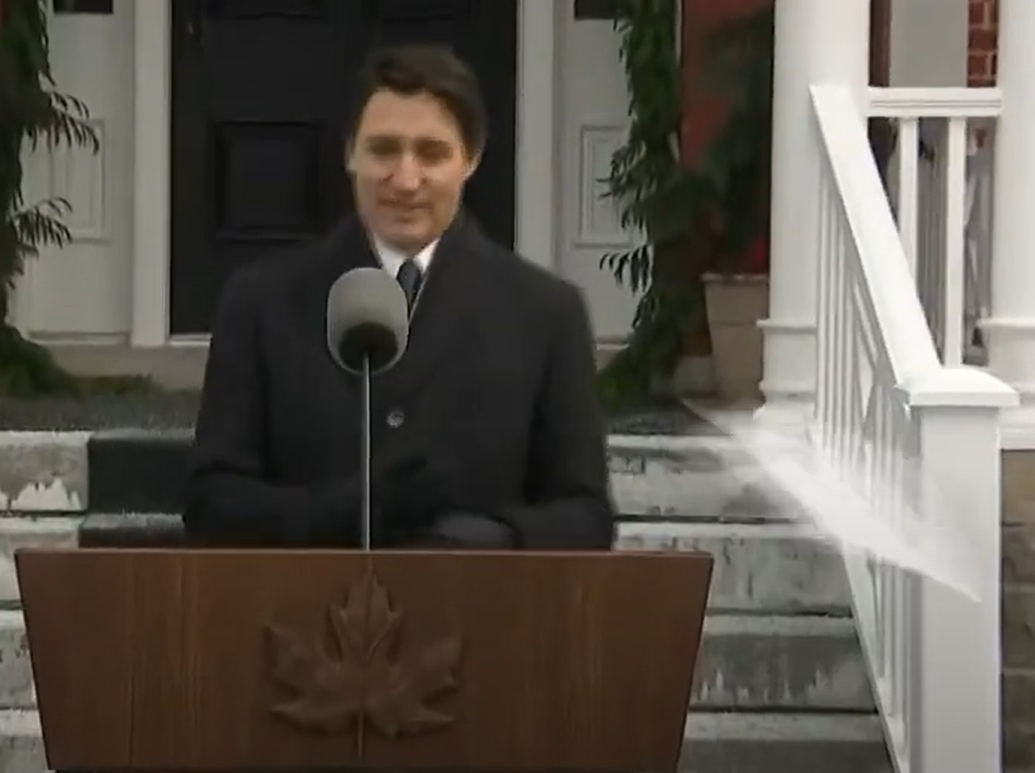

He and other restaurant-goers have caught a break since Dec. 14, when as a result of the federal government’s Tax Break for All Canadians Act, Ontario’s 13-per-cent HST was removed from restaurant meals (including wine and beer, but not spirits).

Advertisement 2

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Elizabeth Payne, David Pugliese, Andrew Duffy, Bruce Deachman and others. Plus, food reviews and event listings in the weekly newsletter, Ottawa, Out of Office.

- Unlimited online access to Ottawa Citizen and 15 news sites with one account.

- Ottawa Citizen ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

- Support local journalism.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Elizabeth Payne, David Pugliese, Andrew Duffy, Bruce Deachman and others. Plus, food reviews and event listings in the weekly newsletter, Ottawa, Out of Office.

- Unlimited online access to Ottawa Citizen and 15 news sites with one account.

- Ottawa Citizen ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

- Support local journalism.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

In effect for two months and meant to assist people struggling with the rising cost of living, the law also applies to qualifying items such as groceries, children’s clothing and selected children’s toys.

The law was roundly criticized in some quarters, with the Fraser Institute, regarded as a conservative think tank, contending that the measure was “a mistake given that the GST is one of the least economically harmful components of the tax mix.”

But Sok was glad for the relief as a consumer, and he’s also an Ottawa restaurateur with his fingers crossed that ByWard market eateries Tomo and Parle by Viet Fresh will increase as a result of the tax holiday.

“It seems like it’s making a difference,” says Sok. “It’s a bit early to gauge, but I think it will cause more of a snowball effect and create a general feeling for people (that) it’s OK to eat out again.”

Restaurants Canada, the national trade association, says the restaurant industry is doing worse today than at any time in recent history, including during the COVID-19 pandemic. A little more than half of Canada’s restaurant companies are operating at a loss or just breaking even, up 40 per cent from the pre-pandemic figure of 12 per cent, says the association.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Advertisement 3

Article content

People with less money for discretionary spending have eschewed going out for dinner. Meanwhile, restaurant operating costs and debt loads have ballooned.

Not all Ottawa restaurateurs are cheering.

Patrick Garland, the chef-owner of Absinthe Cafe in Hintonburg, says the threat of American tariffs on Canada might squelch any enthusiasm for fresh spending. “My thought is that Canadian citizens will benefit in the short term, but they will be paying for it for a long time,” Garland adds.

But Ottawa restaurateurs Joe Thottungal and Stephen Beckta are more optimistic.

“For many, a discount, no matter how small, can make a significant difference in their ability to enjoy a meal out,” says Thottungal, the chef who also owns Coconut Lagoon on St. Laurent Boulevard and Thali on O’Connor Street.

He says he anticipates the tax holiday will prompt many people to “seize the opportunity to celebrate special occasions, especially with Winterlude and Valentine’s Day coming up.

“Overall, this initiative is a win-win, promoting both family engagement and robust support for the restaurant industry,” say Thottungal.

Advertisement 4

Article content

Beckta, the owner of the downtown restaurants Beckta Dining & Wine and Play Food & Wine as well as Gezellig in Westboro, says reservations and spending per customer are up quite a bit over last year. He’s excited “by what January is looking like,” and feels that the combination of lower interest rates and the tax holiday will prompt customers to treat themselves more than they have over the past two years.

Also, his Curated By Beckta side-business, which includes deliveries of meal kits and cases of wine, has enjoyed increased sales as people stock up their wine cellars at a big discount that came into effect with the new law, he says.

Michael Blackie, the chef-owner of NeXT in Stittsville, says sales of his celebrate-at-home packages were up 36 per cent over the recent holiday break.

“I can’t really say if that’s related to the tax break. It probably has a lot more to do with the fact that people are changing what they want to do during the holidays,” he says. Still, he has solid hopes for the sales of NeXT’s at-home packages for Valentine’s Day.

Justin Champagne-Lagarde, the chef-owner of Perch on Preston Street, says his sales in early December slowed a bit as diners waited for the tax savings to kick in. But once the law kicked in, Perch was full almost every day after the middle of December, and January reservations are filling up faster than in previous years.

“Hopefully the slower first half of December will even out or we’ll even come out ahead,” Champagne-Lagarde says.

Recommended from Editorial

-

All of Peter Hum's Ottawa restaurant reviews

-

Peter Hum's best Ottawa restaurant dishes of 2024 represent around-the-world, affordable eating

Article content

.png)

1 day ago

10

1 day ago

10

Bengali (BD) ·

Bengali (BD) ·  English (US) ·

English (US) ·